history repeats itself because the same people continue to get by wielding the same secretive, tyrannical power. when are we going to learn? here are all the warning signs, yet again. easy credit/liquidity (a la the "roaring 20s"), a little bubble is created (housing market) with loans no one ever expects to be able to pay back--we borrow ourselves into a fake prosperity while we lose our manufacturing base and depend almost entirely on the "service" sector, turning us all gradually into serfs--then bam! our financial masters pull the plug and another new-deal type program comes in to save the collective and take away our liberties in the name of some high socialist ideal.

welcome to the global plantation.

The Crashing U.S. Economy Held Hostage

Our Economy is on an Artificial Life-support System

By Richard C. Cook

Go To Original

Remember when the U.S. was the world's greatest industrial democracy? Barely thirty years ago the output of our producing economy and the skills of our workforce led the world.

What happened? It's hard to believe that in the space of a generation our character and capabilities just collapsed as, for example, did our steel and automobile industries and our family farming. What then are the causes of the decline?

Here's how I would put it today: our economy is on an artificial life-support system, a barely-breathing hostage in a lunatic asylum. That asylum is the U.S. and world financial systems which are on the verge of collapse.

The inmates are the world's central bankers, along with most of the financial magnates big and small. The fact is that the economy of much of the world is in a decisive downward slide which the financiers cannot stop because the systems they operate are the primary cause. As often happens, the inmates rule the asylum.

The problems aren't confined to the U.S. Unemployment worldwide is increasing, debt is rampant, infrastructures are crumbling, and commodity prices are rising.

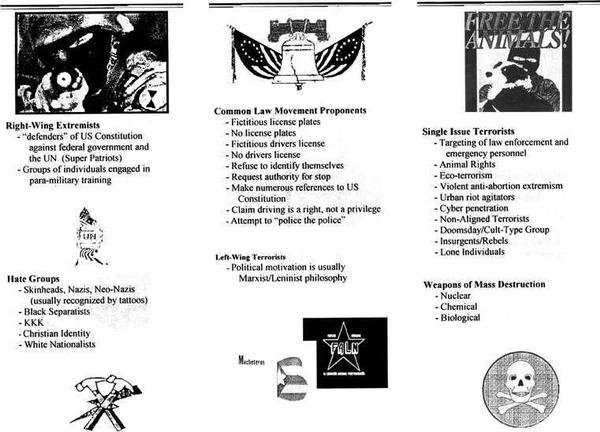

In such an environment, crime, warfare, terrorism, and other forms of violence are endemic. Only the most naïve, self-centered, and deluded jingoist could describe such a scenario in terms of the freedom-loving Western democracies being besieged by the "bad guys."

Rather what is happening highlights the growing failures of Western globalist finance whose impact on political stability has been so corrosive. As many responsible commentators are warning, we are likely to see major financial shocks within the next few months. The warnings are even coming from high-flying institutional players like the Bank of International Settlements and the International Monetary Fund.

We may even be seeing the end of an era when the financiers ruled the world. At a certain point, governments or their military and bureaucratic establishments are likely to stop being passive spectators to the onrushing disorder. It is already happening in Russia and elsewhere.

The countries that will be least able to master their own destiny are those like the U.S. where governments have been most passive to economic decomposition from actions of their financial sectors. The financiers are the ones who for the last generation have benefited most from economies marked by privatization, deregulation, and speculation, but that may be about to change. Whether the change will be constructive or catastrophic is yet to be seen.

THE HOUSING BUBBLE SETS THE STAGE FOR THE U.S. COLLAPSE

Within the U.S., foreign investors, above all Communist China, have been propping up our massive trade and fiscal deficits with their capital. To keep them happy, interest rates—after six years of "cheap credit"—must now be kept relatively high. Otherwise the Chinese, et.al., might bail-out, leaving us to fend for ourselves with our hollowed-out shell of an economy.

Even so, these investors are increasingly uneasy with their dollar holdings and are bailing out anyway. Foreign purchase of U.S. securities has plummeted. And our debt-laden economy, where our manufacturing base has been largely outsourced, is no longer capable of providing our own population with a living by utilizing our own productive resources.

For a while we were floating on the housing bubble, but those days are now history when, according to a Merrill-Lynch study, the artificially pumped-up housing industry, as late as 2005, accounted for fifty percent of U.S. economic growth.

As everyone knows, the Federal Reserve under Chairman Alan Greenspan used the housing bubble, like a steroid drug, to pump liquidity into the economy. This worked, at least for a while, because consumers could borrow huge amounts of money at relatively low interest rates for the purchase of homes or for taking out home equity loans to pay off their credit cards, finance college education for their children, buy new cars, etc.

When the final history of the housing bubble is written, its beginnings will be dated as early as 1989-90, when credit restrictions on the purchase of real estate first began to be eased. According to mortgage industry insiders interviewed for this article, they began to be taught the methods for getting around consumers' weak credit reports and selling them homes anyway in the mid to late 1990s.

The Fed started inflating the housing bubble in earnest around 2001, after the collapse of the dot.com bubble, which failed with the stock market decline of 2000-2002. Then, over a trillion dollars of wealth, including working peoples' retirement savings, simply vanished.

Also according to mortgage specialists, it was in March 2001, two months after George W. Bush became president, that a "wave of intoxicated fraud" started. Mortgage companies began to be instructed, by the creditors/lenders, on how to package loan applications as "master strokes of forgery," so that completely unqualified buyers could purchase homes.

There could not have been a sudden onset of industry-wide illegal activity without direction from higher-up in the money chain. It could not have continued without reports being filed by whistleblowers with regulatory agencies. Today the government is prosecuting mortgage fraud, but they certainly had to know about it while it was actually going on.

The bubble was coordinated from Wall Street, where brokerages "bundled" the "creatively-financed" mortgages and sold them as bonds to retirement and mutual funds and to overseas investors. Portfolio managers were directed to buy subprime bonds as other bonds matured. It's the subprime segment of the industry that has now collapsed, triggering, for instance, the recent highly-publicized demise of two Bear Stearns hedge funds.

And it's not just lower-income home purchasers who are affected. The Washington Post has reported that for the first time in living memory foreclosures are happening in Washington's affluent suburban neighborhoods in places like Fairfax, Loudon, and Montgomery Counties.

The subprime bonds were known to be suspect. One reason was that they were based on adjustable rate mortgages that were actually time bombs, scheduled to detonate a couple of years later with monthly payments hundreds of dollars a month higher than when they were written. Many of these mortgages will reset to higher payments this October.

Purchasers were lied to when they were told they could re-sell their homes in time to escape the payment hikes. Now the collapse of the market has made further resale at prices high enough to escape without losses impossible.

One way the system worked was for mortgage lenders to maximize the "points" buyers were required to finance, making the mortgages more attractive to Wall Street. Of course bundling and selling the mortgages relieved the banks which originated the loans from exposure, pushing a considerable amount of the risk onto millions of small investors. This was in addition to the normal sale of mortgages to quasi-public agencies like Freddie Mac and Fannie Mae.

Was it a scam? Of course. Did the Federal Reserve know about it? They had to. Did Congress exercise any oversight? No.

What did the White House know?

Amy Gluckman, an editor of Dollars and Sense, reported in the November/December 2006 issue: "During the Clinton administration, Greenspan was relatively 'unembedded'—averaging only one meeting per month at the White House….

"But when George W. Bush moved into 1600 Pennsylvania Ave., Greenspan's behavior changed. During 2001, he averaged 3.3 White House visits a month, more than triple his rate under Clinton and much more often with high-level officials like Vice President Cheney. His visits rose to 4.6 a month in 2002 and 5.7 in 2003.

"Whatever White House officials were whispering in Greenspan's ear, it worked: Greenspan abruptly changed his tune on tax cuts, lending critical support to Bush's massive 2001 and 2003 tax giveaways, and he loosened the reins by cutting Fed-controlled interest rates repeatedly beginning in January 2001, a gift to the Republicans in power."

Along the way, the bubble caused housing prices to inflate drastically, which officialdom touted as economic "growth." Even today, periodicals like Barron's naively boast that this inflation boosted American's "wealth."

But this source of liquidity for everyday people has been maxed out, like our credit cards, and there is nothing to replace it. There is no cash cushion anymore, because years ago people stopped earning enough money for personal or household savings.

As purchasers lose their homes to foreclosure, the real estate is being grabbed at bankruptcy prices by the banks and by any other investors with ready money. Whole neighborhoods of cities like Cleveland or Atlanta are turning into boarded-up ghost towns.

What we are seeing are the results of an economic crime on a fantastic scale that implicates the highest levels of our financial and governmental establishments. It spanned three presidential administrations—Bush I, Clinton, and Bush II—though the worst of it came with the surge of outright lending fraud after 2001.

As usual when hypocrisy is rampant only the small fry are being called to account. Commentators, including a sleepwalking Congress, have self-righteously railed at consumers who got in over their heads. The Mortgage Bankers Association is even lobbying Congress to allocate $7 million more to the FBI to go after the supposedly rogue brokers within their own industry who are being scapegoated.

THE BUBBLES ARE ONLY SYMPTOMS

But there's much more to it than that. These bubbles are symptoms. They are created because our wage and salary earners lack purchasing power due to stagnant incomes and various structural causes. These causes include the outsourcing of our manufacturing industries to China and other cheap labor markets and the super-efficiency of the remaining U.S. industry which is able to manufacture products with ever-fewer workers.

Also, our farming, mining, and other resource-based industries are in a long-term slide. This and the decline of hard manufacturing have been going on since our oil production peaked in the 1970s, followed by the Federal Reserve-induced recession of 1979-83. Next came the deregulation of the financial industry. It was all part of the economic disintegration that led to today's "service economy."

Now, for the first time in modern U.S. history, there are no new economic engines at all. The last real engine was the internet which has now reached maturity with marginal players being weeded out.

Our biggest sources of new private-sector jobs today are food service, processing of financial paperwork, health care for the growing numbers of retirees, and menial low-paying jobs, like landscaping and building maintenance. These are increasingly being performed by immigrants who are also underpricing U.S. citizens in many service jobs like childcare and auto repair.

Today the rank-and-file of our population must increasingly turn to borrowing in order to survive. Only the banks and the credit card companies are the beneficiaries. The total societal debt for individuals, businesses, and government is over $45 trillion and climbing. This is happening even while the real value of wages and salaries is decreasing.

What I have just been saying is bad enough, but here's where the real lunacy enters in.

A major factor connected to the decline in the value of employee earnings is dollar devaluation in the overarching financial economy due to the proliferation of huge quantities of bank credit being used to keep the stock market afloat and to fuel the speculative games of equity, hedge, and derivative funds.

In other words, while our factories continue to shut down, the Wall Street gambling casino—like its Las Vegas counterpart—is running full-bore, 24/7. This, along with financing of the massive federal deficit, is what critics are talking about when they speak of the Federal Reserve "printing money."

The main growth factors for federal spending are Middle East war expenditures and interest on the national debt. But within the private sector it's leveraged loans to businesses which The Economist recently said "mirror….interest-only and negative-amortization mortgages" in the subprime market. But here's the big difference: in the leveraged business economy, the amount of assets at stake are even greater than with the housing bubble.

The financial world, which Dr. Michael Hudson calls the FIRE economy—Finance, Insurance, and Real Estate—has been producing millionaires and billionaires among those who know how to play the game.

The Wall Street hedge funds stand out as the most irresponsible financial scams in history. Unregulated and secretive, they account for a third of all stock trades, own $2 trillion in assets, and pay their individual managers over $1 billion a year. Think about this the next time someone you know has their job outsourced to China or when his adjustable rate mortgage resets and drives up his monthly house payment past the level of affordability.

The hedge funds borrow huge sums from the banks which generate loans under their Federal Reserve-sanctioned fractional reserve privileges. Often this money is used by the hedge funds to "short the market," thereby earning profits when stock prices decline.

In other words, the hedge funds and their banking enablers use banking leverage to bet against the producing economy. In doing so, they may actually drive stock prices down, causing ordinary investors to lose a portion of their own wealth. Can this be called anything other than a crime?

The livelihood of much of the U.S. workforce and perhaps half of the rest of the world's population—maybe three billion people—is being threatened by such financial lawlessness. The justification that was first used for financial deregulation and tax cuts for the rich was that the trickle-down effect of wealthy peoples' earnings would spill over to the rank-and-file.

The Reagan administration ushered in these policies in the 1980s under the heading of "supply-side economics." But the opposite has happened. The system has institutionalized an increasingly stratified worldwide culture of haves and have-nots.

THE ROOT CAUSE OF THE CATASTROPHE

How did today's looming tragedy come to pass?

Looking for causes is like peeling an onion. What we are really seeing are the terminal throes of a failed financial system almost a century old. It's happening because, since the creation of the Federal Reserve System in 1913—even during the period of the New Deal with its Keynesian economics aimed at full employment—our economy has been based almost entirely on fractional reserve banking.

This means that under the regime of the world's all-powerful central banking systems, money is brought into existence only as debt-bearing loans. Interest on this lending tends to grow exponentially unless overtaken by real economic growth.

Remember that every instance of bank lending, from purchase of Treasury Bonds, to credit cards, to home mortgages, to billion-dollar loans to hedge funds for leveraged buyouts or sheer speculation, must eventually be paid back somewhere, somehow, sometime, by somebody, with interest. In the end, it all comes back to people who work for a living, whether in the U.S. or elsewhere, because that is the only way the world community ever creates real wealth.

In an anemic economy like that of the U.S., growth cannot catch up with interest in a deregulated financial marketplace where interest rates are high. Rates may not seem high compared with, say, the twenty percent-plus rates of the early 1980s, but they are high in an economy with, at best, a two percent GDP growth rate.

And they have been high on average since the 1960s, as the banking industry became increasingly deregulated. Interestingly, since 1965, the U.S. dollar has lost eighty percent of its value, which tends to validate the contention by some observers that higher interest rates not only do not reduce inflation, as the Federal Reserve contends, but actually cause it.

The situation today is worse in many respects than 1929, because the debt "overhang" vs. real economic value is much higher now than it was then. The U.S. economy was in far better shape in the 1920s, because so much of our population was gainfully employed in factories or on farms.

The question is not when will the system start to come down, because this has already begun. It's shown most clearly by the fact that according to Federal Reserve data, M1, the part of the money supply most readily available for consumer purchases, is not only lagging behind inflation but has actually decreased in eleven of the last twelve months. This means that the producing economy is already in a recession.

The federal government is trying to figure out what to do. Their biggest concern is that foreign investors have started to pull out of dollar-denominated markets.

The government's "plunge protection team"—known officially as the President's Working Group on Financial Markets—is trying to engineer what they call a "soft landing." It's been likened to the process by which you cook a frog in a pot where you raise the temperature one degree a day. The frog doesn't hop out because the heat goes up gradually, but before long it's too late. The frog has been cooked.

Even if the plunge protection team succeeds, and the frog cooks slowly, there will be a massive de facto default on dollar-denominated debt and a long-term degradation of the U.S. standard of living. The inside word is that we are likely to see major monetary shocks and a possible stock market crash as early as December 2007.

The worst off will be people locked into retirement funds which have a heavy load of mortgage-related securities. Entire investment portfolios are likely to disappear overnight.

The banks, along with the bank-leveraged equity and hedge funds, are preparing for the biggest fire sale in at least a generation. Insiders are going liquid to get ready. If you think Enron was "the bomb," you won't want to miss this one.

WHAT CAN BE DONE?

There are so many flaws in the system that it's time for real change.

As I have been pointing out in articles over the last several months, the key to a rational solution would be immediate monetary reform leading to a fundamental shift in how the world conducts its financial business. It would mean taking control of the world's economy out of the hands of the private bankers and giving it back to democratically elected governments.

I spent twenty-one years working for the U.S. Treasury Department and studying U.S. monetary history. For much of our history we were a laboratory for diverse monetary systems.

During and after the Civil War (1861-5) we had five different sources of money that fueled our economy. One was the Greenbacks, an extremely successful currency which the government spent directly into circulation. Contrary to financiers' propaganda, the Greenbacks were not inflationary.

Another was gold and silver coinage and specie-backed Treasury paper currency. The third was notes lent into circulation by the national banks. The fourth was retained earnings—individual savings and business reinvestment of profits—which was the primary source of capital for industry. The fifth was the stock and bond markets.

After the Federal Reserve Act was passed by Congress in 1913, the banks and the government inflated the currency through war debt and destroyed most of the value of the Greenbacks and coinage. The banks never entirely displaced the capital markets but eventually took them over during the present-day era of leveraged mergers, acquisitions, and buyouts, while the Federal Reserve created and deflated asset bubbles.

The banking system which rules the economy through the Federal Reserve System has produced the crushing debt pyramid of today. The system is a travesty. Banks, which can be useful in facilitating commerce, should never have this much power. Many intelligent people have called for the Federal Reserve to be abolished, including former chairmen of the House banking committee Wright Patman and Henry Gonzales and current Republican presidential candidate Ron Paul.

Some might call such a program a revolution. I prefer to call it a restoration—of national sovereignty. Central to the program would be the elimination of the Federal Reserve as a bank of issue and restoration of money-creation to the people's representatives in Congress. This is what our Constitution says too. It's the system we had before 1913.

THE MONETARY PRESCRIPTION

The fundamental objectives of monetary policy should be to secure a healthy producing economy and provide for sufficient individual income. The objectives should not be to produce massive profits for the banks, fodder for Wall Street swindles, and a blank check for out-of-control government expenditures.

Note I referred to income. I did not say "create jobs." That is the Keynesian answer, because Keynes was a collectivist, and the main thing collectivists like to come up with is to give everyone more work to do, even if it's just grabbing a shovel and digging ditches like they did with the WPA during the Depression.

It's what President Clinton did with his welfare-to-work program that threw hundreds of thousands of mothers off the welfare rolls and into a job market where sufficient work at a living wage did not exist. It's another reason the government is constantly borrowing more money to fuel the military-industrial complex by creating more military, bureaucratic, and contractor jobs.

Back to income. The idea of "income," as opposed to "jobs," is a civilized and humane idea. When are we going to realize that everyone doesn't need a paying job in order for an industrial economy to provide all with a decent living? When are we going to realize that the productivity of the modern economy is part of the heritage of all of us, part of the social commons?

Why can't mothers have the choice of staying home with the kids like they could a generation ago? Why can't some people choose to do eldercare? Why can't others comfortably go into lower-paying occupations like teaching or the arts? Why can't some just opt to study or travel for a while or learn new skills or start a business without facing financial ruin as they often must today? Why can't retirees enjoy their retirement instead of having to stay in the job market or worrying about Social Security going broke?

The U.S. and world economies are on the brink of collapse due to the lunacy of the financial system, not because we can't produce enough.

Contrary to so many doomsayers, the mature world economy is capable of providing a decent living for everyone on the planet. It cannot because the monetary equivalent of its bounty is skimmed by interest-bearing debt.

These are things that monetary reformers have known about for decades. The first steps within the U.S. would be 1) a large-scale cancellation of debt; 2) a guaranteed income for all at about $10,000 a year, not connected to whether a person has a job; 3) an additional National Dividend, fluctuating with national productivity, that would provide every citizen with their rightful share in the benefits of our incredible producing economy; 4) direct spending of money by the government for infrastructure and other necessary costs without resort to taxation or borrowing; 5) creation of a new system of private lending to businesses and consumers at non-usurious rates of interest; 6) re-regulation of the financial industry, including the banning of bank-created credit for speculation, such as purchase of securities on margin and for leveraging buyouts, acquisitions, mergers, hedge funds, and derivatives; and 7) abolishment of the Federal Reserve as a bank of issue with retention of its functions as a national financial transaction clearinghouse.

While these proposals are basically simple, the overall program is so different from what we have today with our financier-controlled system that it takes careful reading and a great deal of thought to understand exactly how it would work. One way to approach it is to look at the likely effects.

These measures would immediately shift the basis of our economy from borrowing from the banks to a mixed system that would include the direct creation of credit at the public and grassroots level. The size of government would shrink, our producing economy would be reborn, debt would come down, economic democracy would become a reality, and the financial industry could be right-sized. Finally, the international situation could be stabilized because we would no longer be driven to a constant state of warfare to seize other nations' resources as with Iraq and to prop up the dollar as a reserve currency abroad.

Such a system would work by creating indigenous sources of credit needed to mobilize the natural wealth and productivity of the nation. There are people who could implement this program. Systems to do so could be installed within the U.S. Treasury and the Federal Reserve within a matter of months.

Fundamental monetary reform implemented to restore economic democracy is what America's real task should be for the twenty-first century. One thing is for certain. The out-of-control financial system that has wrecked the U.S. and world economies over the last generation cannot be allowed to continue.

How the outcome will play out may well depend on whether there is a Jefferson, Lincoln, or Roosevelt waiting in the wings. The success of each of these great leaders was due to one critical factor: their ability to implement monetary reform at a time of national emergency.

Richard C. Cook is the author of "We Hold These Truths: The Hope of Monetary Reform," scheduled to appear by September 1, 2007. A retired federal analyst, his career included service with the U.S. Civil Service Commission, the Food and Drug Administration, the Carter White House, and NASA, followed by twenty-one years with the U.S. Treasury Department. His articles on monetary reform, economics, and space policy have appeared on Global Research, Economy in Crisis, Dissident Voice, Arizona Free Press, Atlantic Free Press, and elsewhere. He is also author of "Challenger Revealed: An Insider's Account of How the Reagan Administration Caused the Greatest Tragedy of the Space Age." His website is at www.richardccook.com . He appears frequently on internet radio at www.themicroeffect.com on Saturday mornings at 11 a.m. Eastern.

Nuk ka komente:

Posto një koment